Payment Testing: Best Practices and Checklist

There are lots of various industries that offer users to buy goods, services, and features. First of all, the field of e-commerce continues to develop incredibly fast. It is worth mentioning that other fields, such as trading, brokerage, gambling, dating, and dozens of others also include a feature that allows making deposits. The demand for online shopping and using apps with paid functions is rapidly growing since lots of people are forced to stay at home during the pandemic. Therefore, thousands of apps will require adding payment tools in the near future. But how to test your digital product that allows making any purchases or deposits? The most important thing there is to double-check how payment processing works and fix even the smallest issues. In this post, you will find the most detailed info about payment testing, as well as the hottest tips on how to test your app in the most effective way.

Payment Testing: Basic Concepts

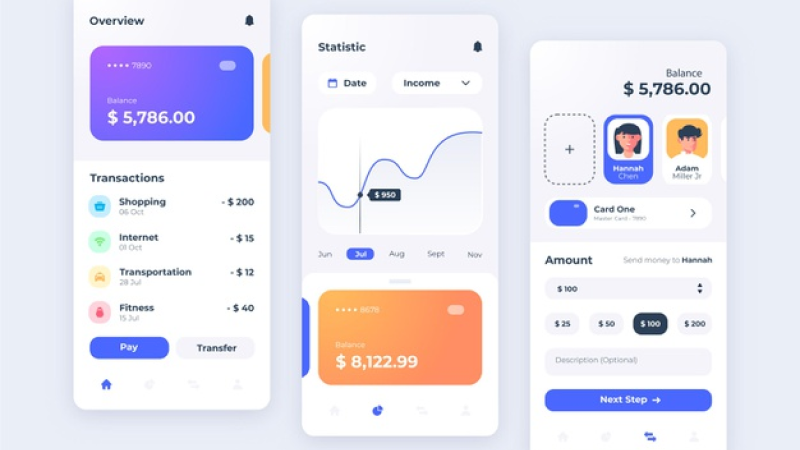

Payment testing is a type of testing that allows checking whether the system of making transactions, purchases, and withdrawals is working properly. It should be secure and reliable, as well as have a clear and user-friendly interface. Moreover, all the information transferred between the user and merchant should be encrypted using the most up-to-date technologies. All the sensitive data, including credit card numbers, expiry dates, card holder’s name, or bank account details should not be available to any third parties. In other words, the customer should be able to make payments in a fast, smooth, and secure way. That is why checking the entire payment process is a must for any service.

Before You Start Payment Testing

Here is a list of features and functions that should be checked before you initiate payment testing:

- Collect data for making tests using various types of cards, including visa, maestro, AMEX, MasterCard, Diners, etc.

- Collect info for checking other types of payments, including PayPal, Google Wallet, iDeal, SEPA, BitPay, PayBox, Venmo, and various types of eWallets that are popular in the different countries/regions.

- Put together all the payment documents with error codes

- Check the language of the app and your payment gateway language

- Double-check the currency format, dates, and collecting the data about the user

- Clarify all the parameters that will be passed from the user to the merchant

How To Test Payment Process?

As a rule, the QA process of testing your application will require several stages. Here is the list of testing types you will need to do to ensure your payment process is safe and convenient.

As a rule, the QA process of testing your application will require several stages. Here is the list of testing types you will need to do to ensure your payment process is safe and convenient.

Functional Testing

This is a stage, where you should test the main functionality of your app’s payment gateway or eWallet deposits. How will the app calculate the orders, save user’s data, and VAT per country? Will it behave the same way? What differences should the interface have when users from different countries place orders or make deposits?

Integration Testing

This type of testing should be performed after you’ve successfully added various types of payment systems to your software. Will it be possible to place orders? How fast will you receive the funds? Will your app support the refund option or withdrawals?

Performance Testing

What if a large number of customers will try to make a purchase in your app simultaneously? Will all the transactions be completed on time? Make sure not to have any data losses or failures during the hot hours for your solution. This is exactly what performance testing will need to check. Don’t forget to spread this testing between load testing tools, and also several dozens of real users using real devices.

Localization Testing

Most digital products require advanced localization testing. For example, in case your app is designed for users who reside in the United States, you will not be able to test Venmo (one of the most popular payment services in the country) with testers from other countries. The fact is that your product can be tested only by QA professionals from the United States that have Venmo. This way, they will be able to test your solution on real devices and make real money transfers via Venmo. Of course, the same rule applies to other countries and payment methods.

Security Testing

The customers will share sensitive information when making purchases. This includes the credit or debit card number, CVV, expiry date, holder’s name, transaction password, forms of IDs, bank details, and more. It is better to double-check whether the process of sharing this info is 100% safe.

Test payment: The Best Practices

There is nothing new that the QA process might often appear to be very challenging. To make your job easier, we’ve collected a number of tips to help you cope with payment testing in the most productive way.

There is nothing new that the QA process might often appear to be very challenging. To make your job easier, we’ve collected a number of tips to help you cope with payment testing in the most productive way.

Double-check The Market Specifics

Each market has its own rules, regulations, and specifics you should perfectly know. For example, PayPal might appear to be unavailable in some countries. Moreover, you should always check VAT, all regulations, and security standards before your solution goes live. This way, you will eliminate the number of unexpected issues, and won’t need to fix your app several times.

A “Happy Path” Is Not The Only One To Be Checked

A “happy path” is a step-by-step guide on how a common user will make a purchase on your site. Of course, it should be tested in detail. But what if the user suddenly chooses something else? To make sure everything is good, you will also need to double-check several unexpected scenarios. To do proper testing, you need to think as a real user and create a list of test cases that will cover all optional scenarios.

Test In Real-life Conditions

It will be really great to make a test with real cards by various users from different locations. The fact is that using emulators or other testing software will never give you a detailed and clear picture of how your app will behave under real conditions. For example, a payment might be accepted but the service will fail to charge the money. In other words, not only should you test your app theoretically, it is always better to get your hands dirty and check every aspect in real environments. It is important to note that the options of transferring money, making deposits, receiving refunds, and dealing with other types of payments requires extremely precise and detailed testing. Just imagine your users losing their money because of a minor mistake in your app! The consequences of a small bug or payment failure because of any product’s issue might be very serious for your business. Therefore, it is better to use a larger number of testers and double-check the functionality of your digital product before it goes live. But how can you test your app in case you don’t have such a whopping number of credit and debit cards, access to local online payment forms, and eWallets? What if you can’t get many devices and carriers to check your payment system? What should you do in case you are planning to sell goods or services to users from different countries? Crowdsourced testing is the ideal solution to be used. How can Crowd Testing Help With Testing Payment Systems? Crowd testing continues to be the one and only solution that allows testing your digital product in real-life conditions by a significant number of QA professionals or beta users. If your target audience is located in different countries, checking your product’s performance on dozens of devices, carriers, and via different payment systems might appear to be a real issue. Fortunately, crowd testing services can become a really life-saving solution that will help you get full-scale testing of any digital product or service developed by your company. The Ubertesters crowd testers are always ready to assist! Want to know more about Ubertesters’ testing possibilities? Contact us at sales@ubertesters.com.