How to Effortlessly Test the Efficiency and Functionality of a Digital Wallet App

The way we manage our finances has undergone a significant transformation. Traditional wallets are being replaced by digital counterparts, providing us with a more convenient and secure way to handle our financial transactions. Digital wallet apps, such as PayPal, Google Pay, and Apple Pay, have become increasingly popular due to their ease of use and versatility. However, with the proliferation of these apps, it's essential to understand how to test their efficiency and functionality. This article will guide you through the world of digital wallet apps—their working mechanisms, popular examples, underlying technologies, and how to perform functional testing for digital wallet apps to ensure their efficiency and reliability. Let's dive in!

What is a Digital Wallet App?

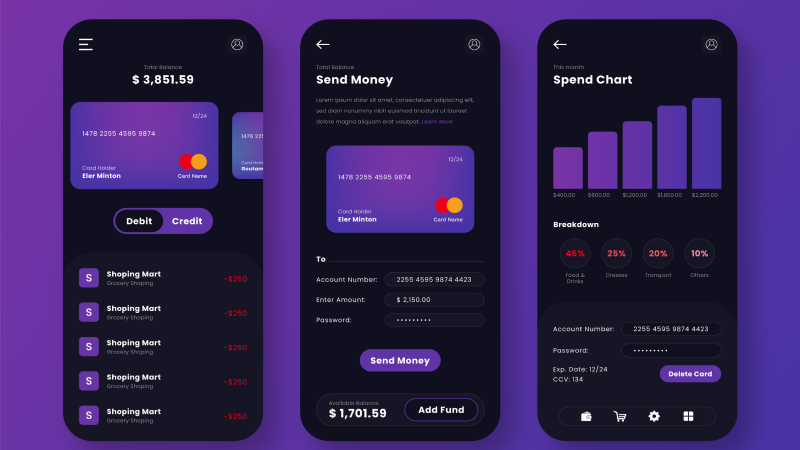

A digital wallet app is a modern, innovative tool that allows users to store and manage their financial assets in a virtual environment. It's essentially a software application installed on a smartphone or other digital device, designed to securely hold digital cash, credit card information, and other forms of payment data. These apps are transforming the way we handle money, making transactions quicker, easier, and more secure.

How Does a Digital Wallet App Work?

Once you've installed the app and linked it to your financial accounts, you can use it to make payments, transfer money, and even track your spending. When you make a payment, the app communicates with the payment terminal, either wirelessly or through quick response (QR) code, and the transaction is processed using your chosen payment method.

Examples of Digital Wallet Apps

There's a wide array of digital wallet apps available today, each with its own unique features. PayPal, for instance, is a global leader in online payments, while Google Pay and Apple Pay offer seamless integration with their respective ecosystems. Venmo and CashApp are popular for peer-to-peer payments, especially among younger users. Samsung Pay offers versatility with its compatibility with both NFC and MST technologies. Alipay and Paytm dominate the Asian market, offering a comprehensive range of services beyond just payments.These are just a few examples and there are many other alternatives for eWallets.

The Most Popular Technologies Digital Wallets Use

Digital wallet apps leverage various technologies to facilitate secure and efficient transactions:

- Quick Response (QR) Codes: These are two-dimensional barcodes that can be scanned using a smartphone camera. They are often used for making payments in stores or for transferring money between users.

- Near Field Communication (NFC): This technology allows two devices placed within a few centimeters of each other to exchange data. In the context of digital wallets, it enables contactless payments at point-of-sale terminals.

- Tokenization: This is a security feature that replaces sensitive data, like credit card numbers, with unique identification symbols (tokens). It enhances the security of digital transactions by ensuring that actual financial details are not exposed during the transaction process.

- Magnetic Secure Transmission (MST): This technology generates a magnetic signal that mimics the magnetic strip on a traditional payment card. It's particularly useful in regions where NFC-enabled payment terminals are not widely available.

What Should Be Tested in a Digital Wallet App?

When evaluating the efficiency and functionality of a digital wallet app, there are several key aspects that should be thoroughly tested:

- User Registration: This is the first interaction a user has with the app. The process should be smooth and straightforward, with clear instructions and minimal steps. Test for any issues in the sign-up process, such as validation errors or difficulties in setting up security features like biometric authentication.

- Bank Account/Card Authorization: The app should securely and efficiently link to the user's bank account or credit/debit card. Check for any glitches in this process, and ensure that all transactions are secure and data is encrypted.

- Replenishing Account/Checking Balance: Users should be able to easily add funds to their digital wallet and check their balance. Test to ensure these features work correctly and the displayed information is accurate.

- Transfers and Receipts: The core functionality of any digital wallet app is to facilitate transfers and provide receipts for transactions. These features should be tested extensively for different scenarios, including transfers to different banks, international transfers, and varying transaction amounts.

- Processing Bills: Many digital wallet apps allow users to pay bills directly through the app. This feature should be tested for various types of bills, such as utilities, credit cards, and subscriptions.

- Rewards and Offers: If the app provides rewards or special offers, these should be tested to ensure they are applied correctly and benefit the user as intended.

- Error Handling: Test the app's response to various error scenarios, such as invalid payment details, declined transactions, network failures, or server errors. Verify that error messages are clear, informative, and guide the user appropriately.

- Cross-Browser and Cross-Platform Compatibility: The app should function seamlessly across different devices, operating systems, and browsers. Test the app on various platforms to ensure a consistent user experience.

Why is Crowd Testing Good for Digital Wallet Testing?

Crowd-testing refers to a platform or method that involves leveraging a diverse and distributed community of freelance testers, often from different backgrounds and locations, to test software or a product to identify bugs, test for usability, provide feedback, and ensure its functionality across various real-world scenarios and devices. A dedicated and assigned project manager makes sure that the test project is performed well and as expected. It is a highly effective method for testing digital wallet apps, and here's why:

- Real Transactions: Crowd testing allows for testing with real transactions, providing a more accurate representation of how the app will perform in real-world scenarios. This can help identify any issues that might not be apparent in a controlled testing environment.

- Supported Platforms and Devices: With crowd testing, you can test the app on a variety of platforms (like iOS and Android) and devices (such as smartphones, tablets, and wearables). This ensures compatibility, consistent functionality, and optimal performance across all devices and operating systems.

- User Interface (UI) and User Experience (UX): Such a type of testing provides valuable insights into the app's user interface and user experience from the perspective of actual users. This can help identify areas for improvement that might not be obvious to developers or in-house testers.

- Scalability: Crowd testing allows you to test the app under heavy load conditions, helping to assess its scalability and performance under pressure. This is particularly important for digital wallet apps, which may need to handle high volumes of transactions simultaneously.

- Cost-Effective Testing Solution: This is a cost-effective solution that doesn't require a significant investment in in-house testing resources. It allows for extensive testing without the associated overhead costs.

- Accurate Results: With a diverse group of testers, crowd testing can yield more accurate results, reflecting a wide range of user experiences and scenarios.

- Synthesized Feedback: Crowd testing provides synthesized feedback from a large group of users, offering a comprehensive view of the app's performance and potential areas for improvement.

- Ability to Test in Remote Physical Locations: This method allows the ultimate testing scenario to be performed - testers can actually go to a physical store, or an agent, in a remote location, and test the eWallet using real transactions.

Conclusion

Digital wallet apps are revolutionizing the way we handle our finances, offering a convenient and secure alternative to traditional payment methods. But, ensuring these apps function efficiently and effectively is crucial. From user registration to transaction processing, each feature needs to be thoroughly tested. Crowd testing offers more than just a practical, cost-effective solution. It brings the invaluable perspective of a vast user base, each interacting with the app in their unique environments and with a real variety of payment methods. This diversity ensures that the app is not only compatible across various devices and platforms but also resonates with different user preferences and cultural nuances. Furthermore, crowd testing taps into real-world scenarios, which traditional lab testing might overlook. This encompasses everything from daily mundane tasks to rare edge cases that could reveal potential vulnerabilities. It's not just about functionality; it's about ensuring that the user experience is intuitive, consistent, and satisfying across the board. By leveraging crowd testing, developers can ensure their digital wallet app offers a seamless, user-friendly experience, ready to meet the demands of the modern consumer. Ready to enhance your testing strategy and achieve superior results through crowd testing? Reach out to us at sales@ubertesters.com to unlock a world of possibilities and discover the full range of benefits awaiting your projects.